YRC OP-086 2015-2024 free printable template

Show details

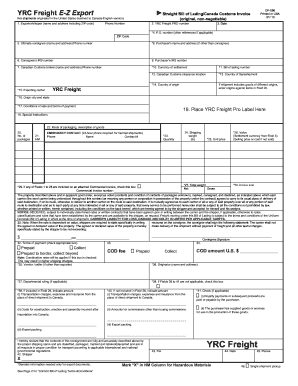

ARC Freight EZ ExportStraight Bill of Lading/Canada Customs Invoice

(original, nonnegotiable)For shipments originated in the United States destined to Canada English version

1. Exporter/shipper (name

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your yrc freight e z form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your yrc freight e z form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing yrc freight e z export online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit yrc version exporter online form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

YRC OP-086 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out yrc freight e z

How to fill out customs information:

01

Gather all necessary documents related to the shipment, such as invoices, packing lists, and any applicable licenses or permits.

02

Provide accurate and detailed information about the sender and the recipient, including full names, addresses, and contact information.

03

Declare the contents of the shipment accurately, specifying the quantity, description, and value of each item.

04

Indicate whether the shipment contains any items that are restricted, prohibited, or require special handling, and provide the necessary documentation if applicable.

05

Fill out the required fields on the customs declaration form, following the instructions provided by the shipping carrier or the customs authority of the destination country.

06

Ensure to sign and date the customs declaration form before submitting it.

07

If necessary, include any additional supporting documentation requested by the customs authority.

08

Review the completed customs information thoroughly for accuracy and completeness before submitting it.

Who needs customs information:

01

Individuals or businesses involved in international trade or shipping goods across borders require customs information.

02

Customs authorities of the destination country require customs information to assess duties and taxes, verify the legality of the goods, and ensure compliance with import regulations.

03

Shipping carriers and freight forwarders need customs information to facilitate the movement of goods and ensure customs clearance procedures are properly followed.

Fill yrc version exporter download : Try Risk Free

People Also Ask about yrc freight e z export

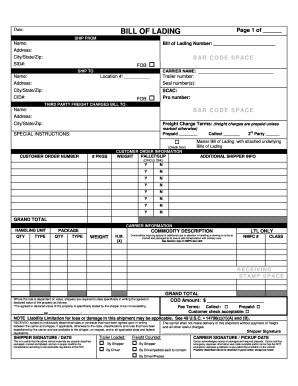

What information is contained on a freight bill?

What information is needed on a bol?

Do all shipments need a bill of lading?

What are the 4 bills of lading?

How many bills of lading do you need for one shipment?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file customs information?

Individuals or businesses that are involved in international trade and shipping are typically required to file customs information. This includes importers and exporters, manufacturers, distributors, freight forwarders, and customs brokers.

How to fill out customs information?

When filling out customs information, follow these steps:

1. Start by obtaining the necessary customs forms. The specific form required will depend on the country you are shipping to or from. Check with your shipping carrier or visit your local post office's website for more information.

2. Provide detailed information about the item being shipped. This includes the item's description, quantity, value, and weight. Be as accurate and specific as possible. For example, instead of simply listing "clothing," specify the type of clothing, such as "3 t-shirts and 2 pairs of jeans."

3. Indicate whether the item is a gift, personal item, or commercial merchandise. This determines the applicable customs duties and taxes.

4. Declare the item's value. Include an accurate and truthful assessment of the item's worth, either in a specific currency or as 'gift' or 'personal item' if applicable.

5. Specify the country of origin. This refers to the country where the item was manufactured, not the country from which it is being shipped.

6. Provide your personal information as the sender, including your full name, address, and contact details. This ensures that customs officials can reach you if necessary.

7. Include the recipient's information. Provide the recipient's full name, address, and contact details. Again, accuracy is crucial.

8. If applicable, attach any supporting documents requested by customs, such as invoices, certificates of origin, or permits. These documents may be necessary when shipping certain items or to specific countries.

9. Sign and date the customs form. This confirms that the information provided is accurate and true to the best of your knowledge.

10. Submit the completed customs form along with your shipment. Keep a copy of the form for your records.

Remember to research and comply with any additional customs regulations specific to the country of destination. It is advisable to consult with a customs expert or shipping carrier if you are unsure about any specific requirements or procedures.

What is the purpose of customs information?

The purpose of customs information is to facilitate the movement of goods across borders and ensure compliance with customs laws, regulations, and procedures. Customs information helps customs authorities and traders properly classify, value, and assess duties and taxes on imported and exported goods. It also helps identify any import or export restrictions, permits, or licenses required for specific products. Customs information plays a vital role in maintaining national security, preventing illegal trade activities such as smuggling and counterfeiting, and providing statistical data for trade analysis and economic planning. Additionally, customs information enables the enforcement of various trade policies, including trade remedies, preferential trade agreements, and regulations related to health, safety, and environmental standards.

What information must be reported on customs information?

When completing customs information, the following information must be reported:

1. Sender's Information: Full name or company name, complete address, and contact details of the sender.

2. Receiver's Information: Full name or company name, complete address (including postal code), and contact details of the receiver.

3. Description of Contents: A detailed description of the item(s) being sent, including the quantity, weight, and value.

4. Harmonized System (HS) Code: A standardized code that identifies the nature of the goods being shipped according to international trade classification systems.

5. Country of Origin: The country where the goods were manufactured or produced.

6. Value of Goods: The declared value of the goods being shipped, including the currency used.

7. Invoice or Receipt: A commercial invoice or receipt that provides proof of the value of the goods.

8. Packing List: A detailed list of all the items included in the shipment, including their quantities and descriptions.

9. Incoterm: An international trade term that defines the obligations, risks, and costs associated with the transportation and delivery of goods.

10. Importer/Exporter Number: If applicable, the importer or exporter number assigned by customs authorities.

11. Non-Delivery Option: In case the shipment cannot be delivered, an instruction for returning the goods to the sender or disposing of them.

It's important to note that the specific requirements for customs information can vary depending on the destination country and the type of goods being shipped. It is advisable to check the customs regulations of the destination country or consult a customs broker for accurate and up-to-date information.

What is the penalty for the late filing of customs information?

The penalty for the late filing of customs information depends on the customs jurisdiction and the specific circumstances of the late filing. Generally, customs authorities may impose financial penalties for late filing, which can vary based on factors such as the nature of the goods, the value of the goods, the reason for the delay, and any prior compliance history. These penalties can range from a percentage of the value of the goods to a fixed amount or a combination of both. It is recommended to consult the customs authority or a customs broker to determine the specific penalties applicable in a particular jurisdiction.

What is customs information?

Customs information refers to the specific details and documentation that customs authorities require for the import or export of goods across international borders. It includes information such as the nature of the goods being transported, their value, quantity, origin, destination, and any applicable duties or taxes. Customs information is crucial for customs authorities to facilitate proper clearance of goods and ensure compliance with import/export regulations and policies. It is typically provided by the importer or exporter to the customs authorities through various forms, such as a bill of lading, commercial invoice, packing list, and customs declaration.

How can I edit yrc freight e z export from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your yrc version exporter online form into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit e z export straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing ez export, you can start right away.

How do I fill out the yrc freight ez export form on my smartphone?

Use the pdfFiller mobile app to fill out and sign yrc ez printable form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your yrc freight e z online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

E Z Export is not the form you're looking for?Search for another form here.

Keywords relevant to yrc united exporter print form

Related to yrc freight straight lading

If you believe that this page should be taken down, please follow our DMCA take down process

here

.